However, debt should not be considered a disadvantage but rather a mechanism through which wealth can be created. Following the proper measures of strategic borrowing, borrowing for investment or business, let alone borrowing, can add value to your worth in the long run. It, therefore, becomes paramount to understand how to use it appropriately and turn it into an advantage.

Good Debt vs. Bad Debt

Understanding the first facet of harnessing debt is knowing the two kinds of debt – good debt and bad debt. The right debt is incurred to purchase assets expected to appreciate over time, such as buildings, education, etc. Unnecessary debt, like credit card debt or personal loans to buy luxury products, includes depreciating assets, which do not create economic value. Sustainable debt helps guarantee that every credit that you make will be profitable in the long run.

Invest in Real Estate

There are many ways to acquire wealth, but real estate is regarded as the most powerful way of using debt for wealth creation. It involves a mortgage and the acquisition of an asset that appreciates over time. Moreover, rental properties can open sources for regular income while the property's value increases. It is this blend of income and appreciation that real estate is regarded as one of the most preferred ownership forms, where people opt to include debt strategically.

Business Loans for Expansion

So, for every businessperson, using debts can increase their income since they have expanded. Working capital can facilitate marketing, purchasing equipment and other assets, and recruitment in cases where the business could not otherwise expand because of inadequate capital. Borrowing in this form, when well planned, can help increase your profits, pay off the loan, and enjoy long-term fruitful benefits.

Leverage the Current Low-Interest Rates

Little-interest loans are equally helpful when borrowing for investments. It implies that the difference between the return on investment and interest on the debt is what you benefit from. For instance, if you borrow capital at the current interest rate of 3% to invest in a portfolio that yields 7%, then you are in for a 4% return. However, such a strategy entails certain risks, so it is necessary to make proper financial calculations.

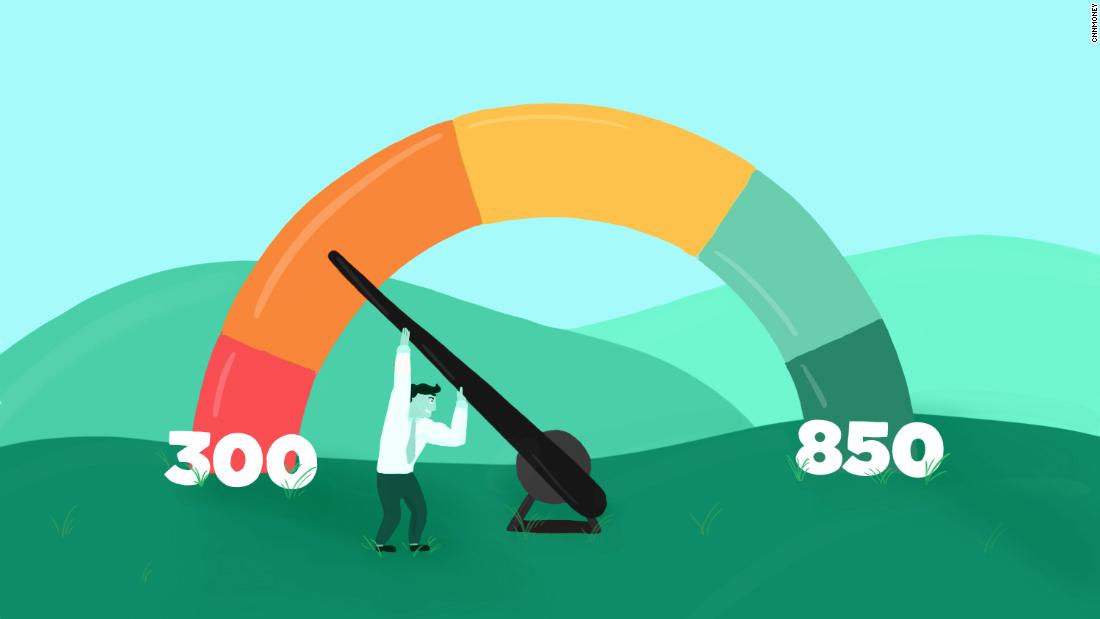

Build and Maintain Good Credit

Credit is crucial when using debt to make wealth. With a high credit score, one should also be able to borrow easily and repay at low costs. Reducing one's credit utilization ratio and making timely payments also helps establish a creditworthy history, so more credit facilities will be available to the borrower.

Diversification Reduces Hazards

It is important to diversify when investing by borrowing money. Diversify by investing in more than just one type of property: It is wise to have investments in real estate, equities, fixed income, and other investment opportunities. In this way, even if one of these investments turns sour, the others may compensate for the poor performance and ensure that your wealth-building plan is not affected.

Monitor and Adjust

Managing debt is not a one-time proposition. That is why it is mandatory to periodically revisit the outstanding balances and the cost of funds and redefine the work on investments. Be flexible where possible—that may mean refinancing loans at lower rates or selling marginal assets to pay off more quickly. Close monitoring prevents complacency and allows your strategy to stay relevant and aimed at your financial objectives.

Pay Down High-Interest Debt

The critical priority before using debt to acquire wealth is to get rid of detrimental high-interest debt. Debt incurred in the form of credit card repayment or personal loans attracts high interest rates, which will reduce the gains. These should be paid as soon as possible so that one does not pay excessive interest on the credit card balances.

Conclusion

Using debt as a source is effective, especially if it is done tactfully. When good debt is borrowed, assets that generate wealth appreciate, and the debt is diversified, so borrowed money becomes wealth. So always focus on interest rates, keep track of your investments, and be wise regarding credit so that debt plays in your favor.